mass wage tax calculator

How much do you make after taxes in Massachusetts. Tax year 2020 File in 2021 Nonresident.

A Complete Guide To Filing Taxes As A Photographer

For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. For tax years 2020 and 2021 compensation paid to a nonresident for services that would normally be performed in Massachusetts are treated as Massachusetts source income. Import Your Tax Forms And File For Your Max Refund Today.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Get Your Max Refund Today. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

The 15th day of the 4th month for fiscal year. Ad Calculate your tax refund and file your federal taxes for free. Massachusetts Income Tax Calculator 2021 If you make 90000 a year living in the region of Massachusetts USA you will be taxed 17067.

After a few seconds you will be provided with a full. Your average tax rate is 1421 and your. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Massachusetts residents only.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Get Your Max Refund Today. Well do the math for youall you need to do is.

On or before April 15 for calendar year filings. It is not a substitute for the. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the.

Withholding refers to income tax withheld from wages by employers to pay employees personal income taxes. Massachusetts State Unemployment Insurance SUI On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Based on your projected tax withholding for the year we can also estimate. Massachusetts Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. The state-level payroll tax is 075 of taxable wage up to 137700 and the income tax is a flat rate of 5.

Enter your salary or wages then choose the frequency at which you are paid. A single filer will take home. Massachusetts allows employers to credit up to 765 in earned tips against an employees wages per hour which can result in a cash wage as low as 435 per hour.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. As an employer you must withhold Massachusetts. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Massachusetts Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state. Get A Jumpstart On Your Taxes. Import Your Tax Forms And File For Your Max Refund Today.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Most Massachusetts employers must make payroll withholdings on behalf of their workforce to comply with the Paid Family and Medical Leave law. Get A Jumpstart On Your Taxes.

Your average tax rate is 1198 and your. Massachusetts Bonus Tax Aggregate Calculator Change state This Massachusetts bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct. Enter your filing status income deductions and credits and we will estimate your total taxes.

Massachusetts Income Tax Calculator Overview of Massachusetts Taxes Massachusetts has a flat income tax rate of 500 as well as a flat statewide sales tax rate of.

H Block Tax Calculators Financial Money Tax Calculator Tax Refund Hr Block Tax

Online Property Tax Calculator In Punjab Excise Punjab Gov Pk Property Tax Online Checks Paying Taxes

Massachusetts Income Tax Calculator Smartasset Com Income Tax Income Tax

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Rental

Where Do Your Taxes Really Go Infographic Us On Behance Infographic Tax Filing Taxes

Open Tax Solver V18 00 Easy To Use Program For Calculating Tax Return Forms Opensource Taxes Taxseason Tax Software Tax Return Tax Time

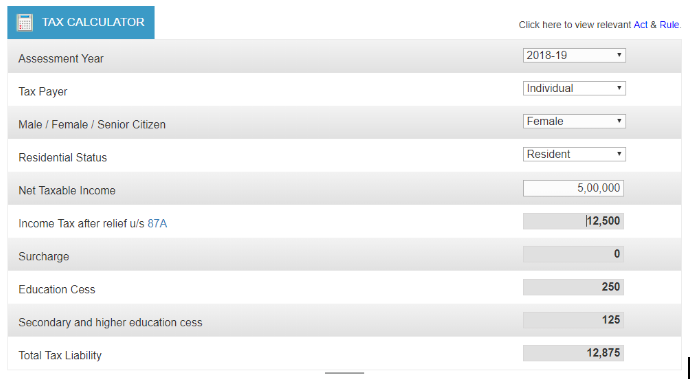

Advance Tax How To Calculate Make Advance Tax Payment Online Tax Tax Payment Payment

Salary Calculator Salary Calculator Calculator Design Salary

Income Tax Act 1961 Basics That You Need To Know

Massachusetts Retirement Tax Friendliness Smartasset

In Case You Missed It Today Is Tax Day For The Us That Means You Need To Get Your Taxes Submitted Stamped Or An Extension File Tax Day You Got This

Salary Calculator Cover Letter For Resume Free Technology Social Studies Teacher

Basic Salary In India Explained With Calculation

Best Tax Accountants Near Me Audit Services Tax Accountant Accounting

Massachusetts Retirement Tax Friendliness Smartasset

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Do You Want To Hire Best Chartered Accountants In Croydon Let Me Help You In This Regard Make More Money Mortgage Info Tax Credits

Does Your State Have An Individual Alternative Minimum Tax Under The Federal Individual Alternative Minimum Tax Amt Legal Marketing Tax Lawyer Income Tax